- July 9, 2025

- Posted by: Daniel Lefstad

- Category: News

No Comments

July 9th, 2025

SDRP Supplemental Disaster Relief Program was announced today and will come in 2 different stages. Stage 1 includes producers that had qualifying multi-peril crop insurance claims in 2023 and 2024. For Stage 1, prefilled applications will be mailed to producers today or a producer may apply to their local FSA office starting July 10th. Stage 2 for shallow or uncovered losses will begin in early fall.

- Producer’s Eligibility– must be a US citizen or resident alien

- Eligible losses must be the result of a natural disaster occurring in calendar years 2023 and/or 2024 including wildfires, hurricanes, floods, derechos, excessive heat, tornadoes, winter storms, freeze (including a polar vortex), smoke exposure, excessive moisture, qualifying drought. (Counties that have had D2 -severe drought for eight consecutive weeks or D3 -extreme drought or higher at any point during the applicable calendar year. Since hail is not a qualifying loss, you could still qualify if you also received excess moisture along with the hail.

- How to apply – FSA will generate an FSA 526 SDRP Stage 1 Application prefilled with information from RMA and FSA for each crop year. This will be sent to you or you can call your local FSA office and they can generate the application.

- Producer’s must certify on the FSA 526 that they will purchase Federal Crop Insurance for the next 2 available crop years

- Payment Limitations are $125,000. Producers may submit FSA 510 Request for Exception to the $125,000 Payment Limitation if their average adjusted gross farm income is at least 75% of the average adjusted gross income increasing the limitation to $900,000 for specialty crops and $250,000 for other crops.

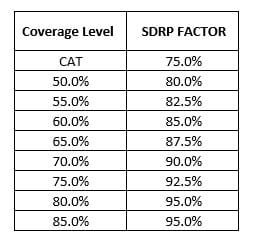

SDRP payment factors:

- SDRP calculation uses the RMA loss procedures for the type of coverage purchased but it will substitute the application SDRP factor for the policy’s coverage level. The result of that calculation will then be adjusted by subtracting the net crop insurance indemnity (gross crop indemnity for the crop and unit minus the administrative fees and premiums)

- Example: Expected value of a crop (APH x MPCI price) is $500,000 at 70% coverage or $350,000 in liability. The producer suffered a crop loss, and their production was valued at $250,000 resulting in a gross indemnity of $100,000 and premium of $10,000

- SDRP payment calculation:

- $500,000 (expected value) x 90% (SDRP factor) = $450,000

- $450,000 – $250,000 (value of production) – $90,000 (net indemnity $100,000 less premium $10,000) = $110,000 x 35% (payment factor ) = $38,500 first payment. If SDRP funds remain available after Stage 2 payments are issued, FSA may issue additional Stage 1 payments.

We will forward any additional information to you as we learn more about the program.